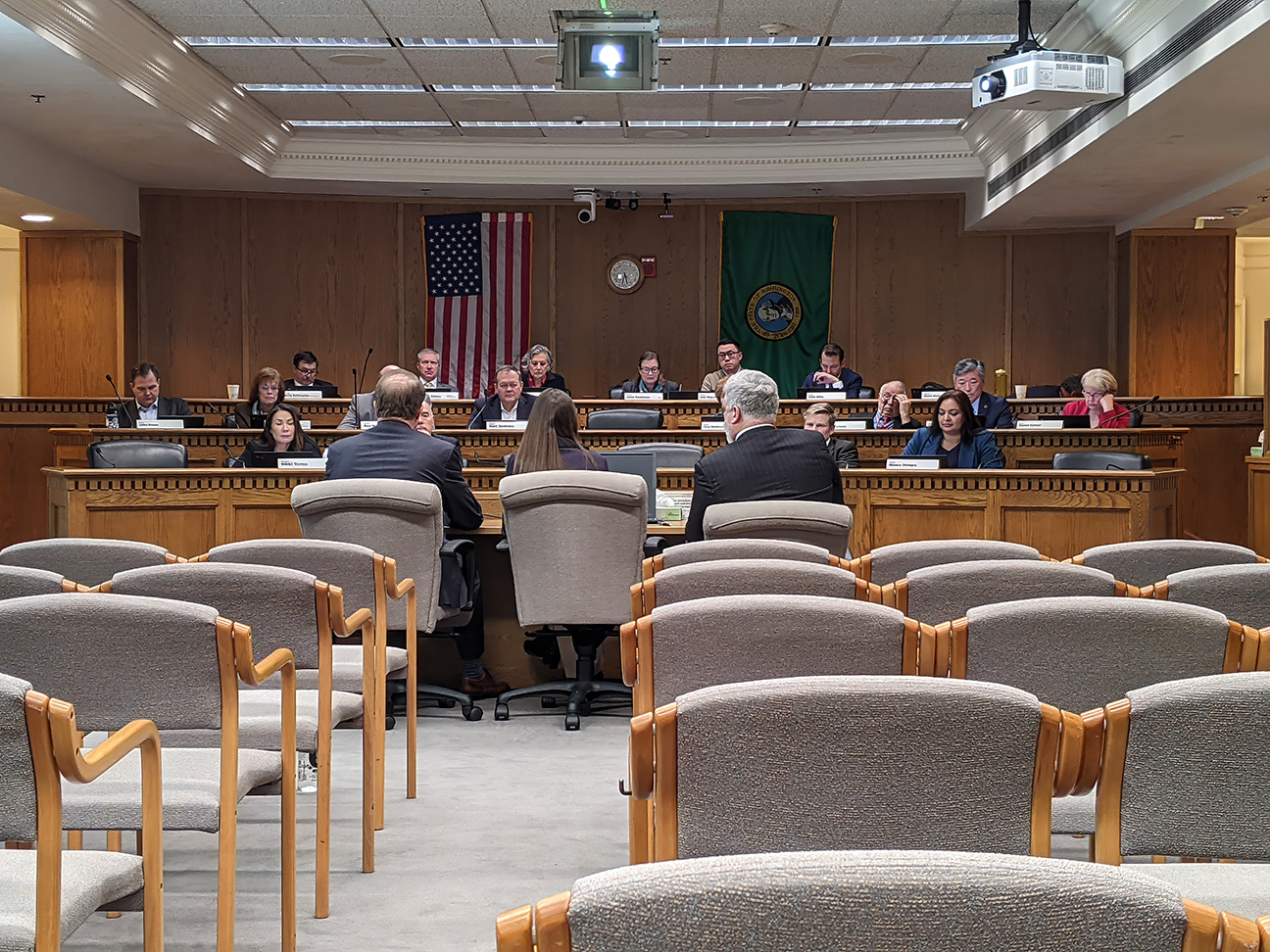

Editor’s Note: The following are the prepared remarks of NPI’s founder and executive director in support of Senate Bill 5770, a bill before the Washington State Senate from Senator Jamie Pedersen (D‑43rd District: Seattle) providing for state and local property tax reform. The intent section of the original bill correctly noted that “the arbitrary one percent limitation on the growth of property tax collections has severely inhibited the ability of the state, counties, cities, and other special districts to provide critical community services in the face of significant population growth and inflation.” The Senate Ways & Means Committee today held a hearing on a proposed substitute for SB 5770.

Chair Robinson, Ranking Member Wilson, Members of the Committee:

Good evening. For the record, I am Andrew Villeneuve, the founder of the Northwest Progressive Institute, testifying PRO on Senate Bill 5770.

It’s critical that we explore ideas to deliver property tax reform to Washingtonians and empower our local elected leaders to govern responsibly.

It’s important to remember that taxes aren’t just obligations — they are also investments. Without taxes, we wouldn’t have a state.

This substitute differs substantially from the original legislation — it might as well be a brand new bill — and I encourage people who are listening to this hearing to actually read the substitute. You’ll need to open the electronic bill book because the only text currently shown on the bill page is the original bill.

Tim Eyman’s Initiative 747, which dates back to 2001, is a failed policy that is choking the life out of our essential public services, especially in areas that have not been passing levies to address priorities like behavioral health, public safety, or transportation. We can’t afford for I‑747 to remain on the books for another twenty years. As Senator Pedersen [prime sponsor of SB 5770] mentioned, continuation of the status quo will have negative ramifications for public safety.

The Legislature needs to take action to make property taxes fairer and more equitable for taxpayers and more dependable for our local governments.

We have found in our research substantial and ongoing support for overhauling our property tax code to lessen obligations for low and middle income families while raising them on the wealthy. For example, in October 2022, we asked:

QUESTION: Do you strongly support, somewhat support, somewhat oppose, or strongly oppose legislation that would reduce property taxes for middle and lower-income households, while slightly increasing them for wealthy families, with no loss of revenue to public services?

ANSWERS:

- Support: 66%

- Strongly support: 48%

- Somewhat support: 18%

- Oppose: 27%

- Somewhat oppose: 7%

- Strongly oppose: 20%

- Not sure: 7%

Our survey of 782 likely 2022 Washington State midterm voters was in the field from Wednesday, October 19th through Thursday, October 20th, 2022. The survey was conducted by Public Policy Polling for the Northwest Progressive Institute and has a margin of error of +/- 3.5% at the 95% confidence interval.

It utilized a blended methodology, with automated phone calls to landlines (50%) and text message answers from cell phone only respondents (50%).

More information about the survey’s methodology is available here.

This bill does not create a homestead exemption but we encourage the committee to think about pursuing this idea in order to provide tax fairness to even more Washingtonians. A renter’s credit could be paired with a homestead exemption.

Many of our public services are badly underfunded, so we need solutions that both provide more revenue as well as greater fairness and equity for our people.

Thank you for hearing this bill and thank you, Senator Pedersen for your thoughtful work and willingness to tackle a very thorny problem.