Happy Labor Day! In the runup to today’s celebration of the gains won by working people throughout our country’s history, Seattle’s JumpStart revenue package has been back in the news, mostly because Amazon recently disclosed that it wants to hire a lot of people for positions based in the Emerald City despite the City Council’s 2020 adoption of a new tax on big employers that’s meant to fund needs like attainable housing, environmental justice, and community development.

“Amazon’s hiring spree is concentrated in Seattle, where the company, Washington state’s largest private employer, has nearly 12,500 open roles, more than in any other city,” a September 1st article by Seattle Times reporter Katherine Long explained. (Those open roles are for jobs on Amazon’s corporate and tech side, though it’s also looking for more warehouse workers.)

An important subsequent passage in Long’s article notes that Amazon is doing all of this hiring in spite of the City Council’s decision to enact JumpStart.

“The company’s hiring plans offer a degree of rebuke to concerns from business groups that Seattle’s JumpStart payroll tax, which took effect this year, could prompt large employers like Amazon to leave the city. The Downtown Seattle Association and Seattle Chamber of Commerce, for instance, have warned that the tax, of between 0.7% and 2.4% of salaries over $150,000 for businesses with at least $7 million in payroll, could have a chilling effect on business.”

Danny Westneat tacked on to Long’s reporting in a column than ran yesterday.

“Yeah, the thing about that payroll tax — it’s just not a showstopper. It’s a percentage or two, levied in tiers on salaries above $150,000,” Westneat observed. “Sure, Amazon could move everyone to Bellevue to avoid it, but, believe it or not, tons of Seattle Amazonians don’t want to commute to Bellevue. And if Amazon were to move to most other places around the country, they’d pay more in income taxes than this payroll tax anyway.”

That’s all true. But what’s also important to note is that unlike a few years ago, when the City Council approved a similar tax on firms like Amazon, only to reverse itself a few weeks later after polling showed the tax would likely not survive a ballot fight, the JumpStart plan enjoys deep support from voters.

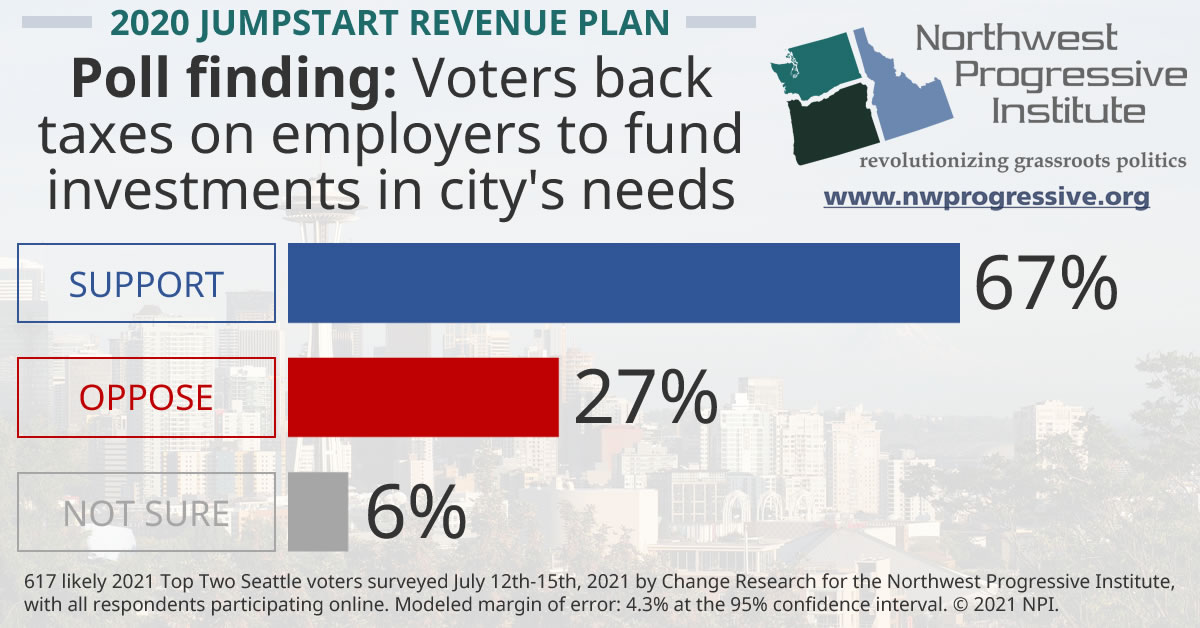

We know because we asked voters for their views on JumpStart back in July as part of our July 2021 Top Two survey of the Seattle electorate.

We found that 67% of Seattle voters support JumpStart, with 27% opposed and 6% not sure. That’s a margin of well over two-to-one.

Notably, fifty percent of respondents — that’s half of everyone who took the survey — said they “strongly” supported the JumpStart plan.

And these numbers were obtained an entire year after the Council voted to pass JumpStart. Clearly, the package has aged well with the public in addition to holding up just fine in court. (The Chamber challenged its legality in King County Superior Court, but so far, JumpStart remains intact.)

Here is the exact question we asked and the responses that we received:

QUESTION: In July of 2020, the Seattle City Council levied a new tax on large employers to fund economic relief and core services during the coronavirus pandemic. The tax, which is expected to raise more than $200 million per year for long term housing, local business assistance and community development, is only paid by employers with over $7 million in annual payroll expenses and who have at least one employee making $150,000 a year or more. Do you support or oppose this tax?

ANSWERS:

- Support: 67%

- Strongly support: 50%

- Somewhat support: 17%

- Oppose: 27%

- Somewhat oppose: 9%

- Strongly oppose: 18%

- Not sure: 6%

Our poll of 617 likely August 2021 Seattle voters was in the field through Monday, July 12th, through Thursday, July 15th. All respondents participated online. The poll was conducted by Change Research for the Northwest Progressive Institute, and has a modeled margin of error of 4.3% at the 95% confidence interval.

We’ve noticed across all of our polling that voters in the Pacific Northwest are very enthusiastic about requiring the rich and big corporations to pay more in taxes. The inequity in our tax code and the chronic underfunding of our essential public services are both problems that can be addressed with progressive tax reform.

The coronavirus pandemic has exposed even more painfully the need for tax reform at every level. And it’s led to long overdue action. A few months after Seattle enacted JumpStart, the Washington State Legislature finally — finally! — voted to approve a capital gains tax on the wealthy, in one of the biggest victories ever for progressive tax reform in this state. Like JumpStart, that legislation is now being challenged in court, but has yet to be challenged at the ballot.

The Chamber’s opposition, while misguided, is to be expected.

Reading Long’s article from last week brought to mind a passage from one of my old United States government textbooks about lobbying. The passage was in a chapter about interest groups and their lobbying activities, and it noted that many business owners simply don’t have much in common aside from a desire for lower taxes and fewer regulations. All businesses would like lower taxes, so the Chamber fights for that, the text observed. (I’m paraphrasing.)

The problem with this mindset is that it views taxes as an affliction when in fact that is not the case. Taxes are investments. It is only by pooling our resources that we can afford all the things that businesses needs to be successful, whether that’s interstate highways, airports, and seaports for getting goods to market, or courts to enforce contracts and resolve business disputes, or fire departments to save buildings from burning down, or environmental protections that stop pollution and prevent depletion of renewable resources like fisheries and forests.

Business executives know all this.

Yet many continue to disingenuously argue for lower taxes on their company or their industry or even the private sector as a whole despite the country’s increasingly dire social and infrastructure needs. Then some of those same folks turn around and say we’ve already borrowed too much and we can’t afford the investments that President Biden and congressional Democrats have proposed.

Actually, what we can’t afford is to not make those investments.

If we fail to act now, we will still need what’s in the Jobs & Families Plan down the line, but it will cost us more. The Jobs & Families Plan doesn’t only make moral sense, it makes financial sense, too, just like Washington’s new tax on the wealthy’s capital gains or Seattle’s JumpStart revenue plan.

Tax cuts do not create a foundation for broad prosperity and neither does austerity. Only investments in essential public services do that, for, in the words of George Lakoff, the private depends on the public.

Businesses and business groups, Amazon included, need to frame shift. They need to stop looking at taxes as a negative and see them as a positive, just as Seattle voters are already doing, according to our research.

If Seattle is to house its homeless population, for instance (something we know the business community wants to see happen) then we need to construct more attainable housing. And we know from experience that merely relying on market forces to supply that housing isn’t going to work. That’s why it’s so important that we not only keep JumpStart in place, but build on it.