The Los Angeles Times’ David Lauter reports: “Many of the nation’s richest people said after the January 6th, 2021, attack on the U.S. Capitol that they would never again back former President Trump. Now, they’re changing their minds.”

Launch

Offering asides, recommended links, blogworthy quotations, and more, In Brief is the Northwest Progressive Institute's microblog of world, national, and local politics.

The Los Angeles Times’ David Lauter reports: “Many of the nation’s richest people said after the January 6th, 2021, attack on the U.S. Capitol that they would never again back former President Trump. Now, they’re changing their minds.”

Launch

Ultra MAGA lackeys of Donald Trump who currently control the United States House of Representatives want to force the Senate and the Biden administration to reverse the investments made to Amtrak and clean drinking water infrastructure as part of the Infrastructure Investment and Jobs Act, which is unacceptable to Democrats.

Launch

Jonathan Levin of Bloomberg explains why a billionaire’s decision to symbolically move his firm’s headquarters is not actually about taxes, despite his grandstanding.

Launch

Read this Washington Post article about IRS preparations for “a normal tax season,” made possible by the Inflation Reduction Act that was passed into law solely with Democratic votes.

Launch

Watch the speaking program of the January 26th, 2023 rally to support our state’s capital gains tax on the wealthy organized by Invest in Washington Now.

Launch

“Has the worst of the pandemic-induced inflation already passed? The latest economic data released this week suggest so. That leaves Republicans in a quandary,” Jennifer Rubin writes.

Launch

“Repealing capital gains tax would give King County’s uber wealthy a huge, unnecessary tax break,” explains Washington State Budget & Policy Center senior fellow Andy Nicholas.

Launch

“Sanders, just weeks from his eightieth birthday, is on the cusp of leaving an indelible mark on the federal government, having shepherded a $3.5 trillion spending blueprint through the Senate this week,” The Washington Post’s Mike DeBonis reports.

Launch

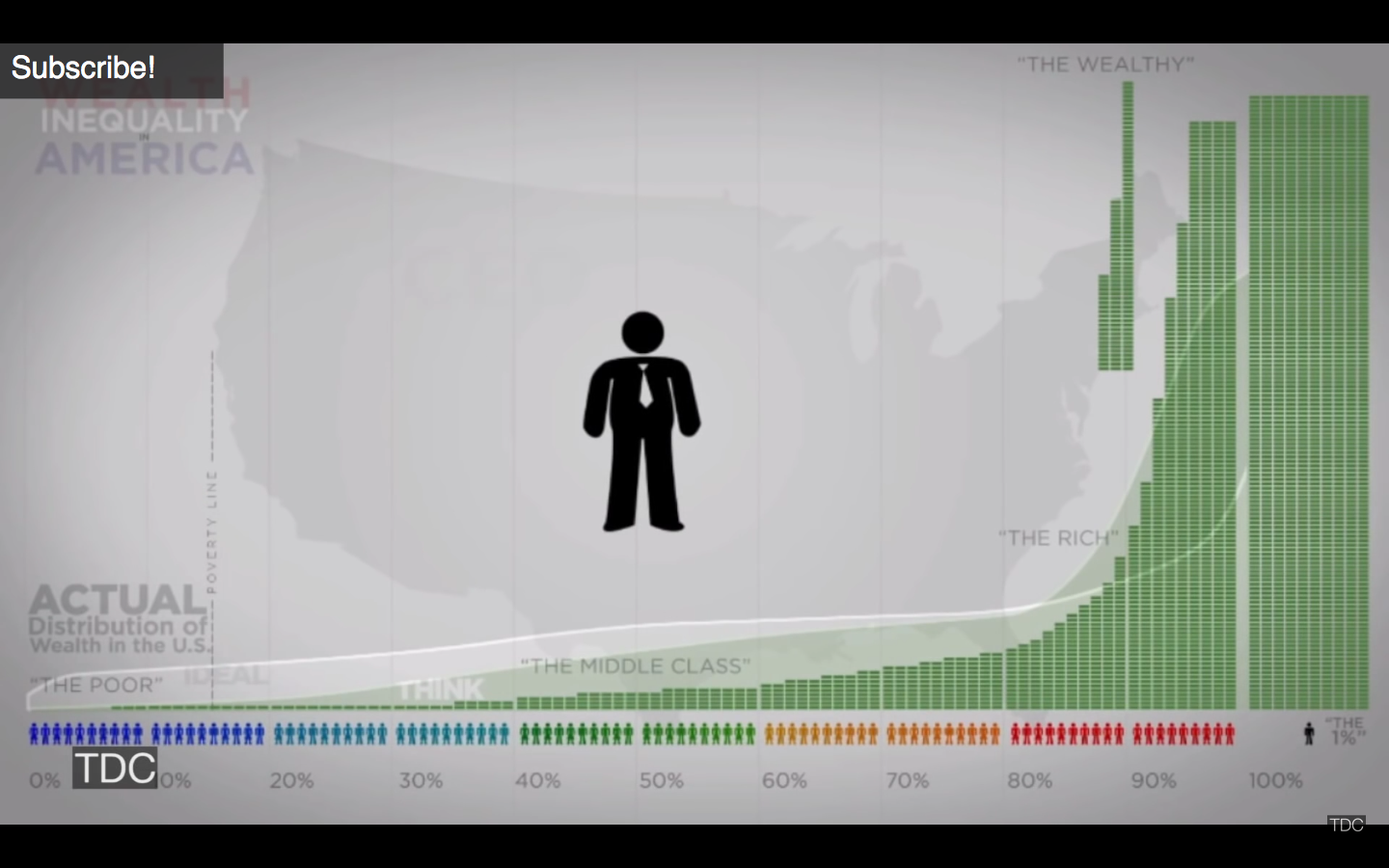

A new paper from the London School of Economics reinforces what progressive activists and economists already know: Trickle down doesn’t. Tax cuts for the wealthy do not create jobs. In fact, they result in greater wealth hoarding and income inequality. It’s time to require the wealthy to pay their fair share in dues to our world community.

Launch

“The need for a Green New Deal can rendezvous with the imperative of anti-depression public investment. Much of this sweeping proposal is on the drawing boards and has not been done for lack of funding. Some of it will take some advance planning. The time to start is now.”

Launch

Paul Krugman brings the truth in a New York Times column about the IOKIYAR principle (Debt, doomsayers and double standards)

Launch

Imagine if Tim Eyman became governor and began taking an axe to Washington’s public services. That’s what is happening in Alaska, where right wing extremist Mike Dunleavy is using his line item veto power to force through a 41% cut to the University of Alaska system, plus gut Medicaid, behavioral health, and the Alaska State Ferry system.

Launch

“Fully 60% of millionaires support Warren’s plan for taxing the wealth of those who have more than $50 million in assets,” CNBC reports.

Launch

Nancy Pelosi and Chuck Schumer met with Donald Trump at the White House and got exactly what they came for.

Launch

“We’re going to have a challenging midterm anyway, and I don’t see how putting the attention on shutting down the government when you control the government is going to help you.”

Launch

The Washington Post’s Dana Milbank finally trains his ire on a deserving figure for once.

Launch

Michigan State University economist Mark Skidmore, discussing his team’s startling finding about the Pentagon’s expenditures (MSU scholars find $21 trillion in unauthorized military spending; Defense Department to conduct first-ever audit).

Launch

“Republican policies in the ’20s instead pushed to concentrate more of the income at the top. Nine decades later, Republicans are rushing to do it again — and they are sprinting toward an economic cliff. Another round of Government of the People, by the Republicans, for the super-rich will be catastrophic. The American people must call a halt before it’s too late,” writes Robert S. McElvaine.

Launch

Professor Stephanie Kelton, who teaches public policy and economics at SUNY Stony Brook, has written the op-ed of the year, explaining how U.S. fiscal policy really works.

Launch

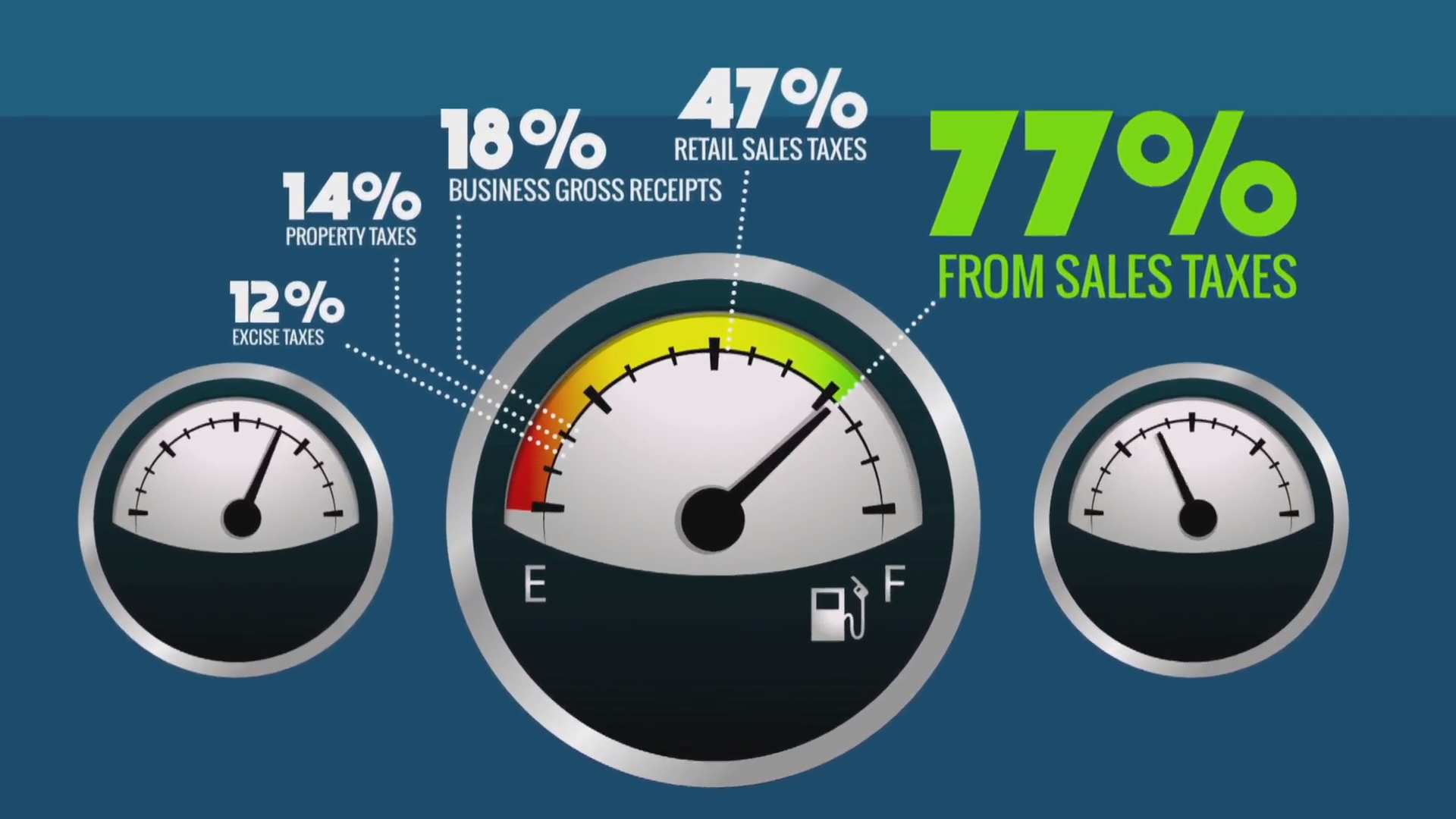

KCTS9: What’s Up With Washington State’s Tax System? Washington state’s vibrant and diverse economy doesn’t hint at it. Neither does Seattle’s red-hot construction and tech

Launch

Money for war is magically always there; money for healthcare must be counted bean by bean. — Adam Johnson: There are three types of single-payer

Launch