Editor’s Note: The following are the prepared remarks of NPI’s founder and executive director in support of levying a wealth tax on billionaire fortunes. Bills to do this have been introduced this session in both the House and the Senate. The Senate Ways & Means Committee held a hearing on its version this evening.

Good evening, Senators.

For the record, I’m Andrew Villeneuve from the Northwest Progressive Institute, here in strong support of Senate Bill 5426.

We’ve heard a lot of testimony so far tonight on why Washington should levy a wealth tax. Our team has been studying this idea as part of our statewide research, and it’s one of the most popular tax reform ideas we have ever tested. Our polling and other polling we’ve seen is extremely robust. Support for a wealth tax starts at about 60% and goes up from there in the body of polling we’ve seen.

Here is the text of the question we asked in our May 2021 statewide survey and the responses that we received from nearly 1,000 likely voters:

QUESTION: Do you strongly support, somewhat support, somewhat oppose, or strongly oppose levying a one percent wealth tax on Washington residents whose worldwide wealth exceeds one billion dollars, to benefit public services here in our state?

ANSWERS:

- Support: 60%

- Strongly support: 50%

- Somewhat support: 10%

- Oppose: 36%

- Somewhat oppose: 11%

- Strongly oppose: 25%

- Not sure: 5%

Our survey of 992 likely 2022 Washington State voters was in the field from Tuesday, May 25th through Wednesday, May 26th, 2021.

The poll utilizes a blended methodology, with automated phone calls to landlines (50%) and text message answers from cell phone only respondents (50%).

It was conducted by Public Policy Polling for the Northwest Progressive Institute, and has a margin of error of +/- 3.1% at the 95% confidence interval.

Why are Washingtonians so enthusiastic about levying a wealth tax?

Our team thinks it’s because the voters of our state understand that it’s always been part of the genius of America to pool our resources to get things done.

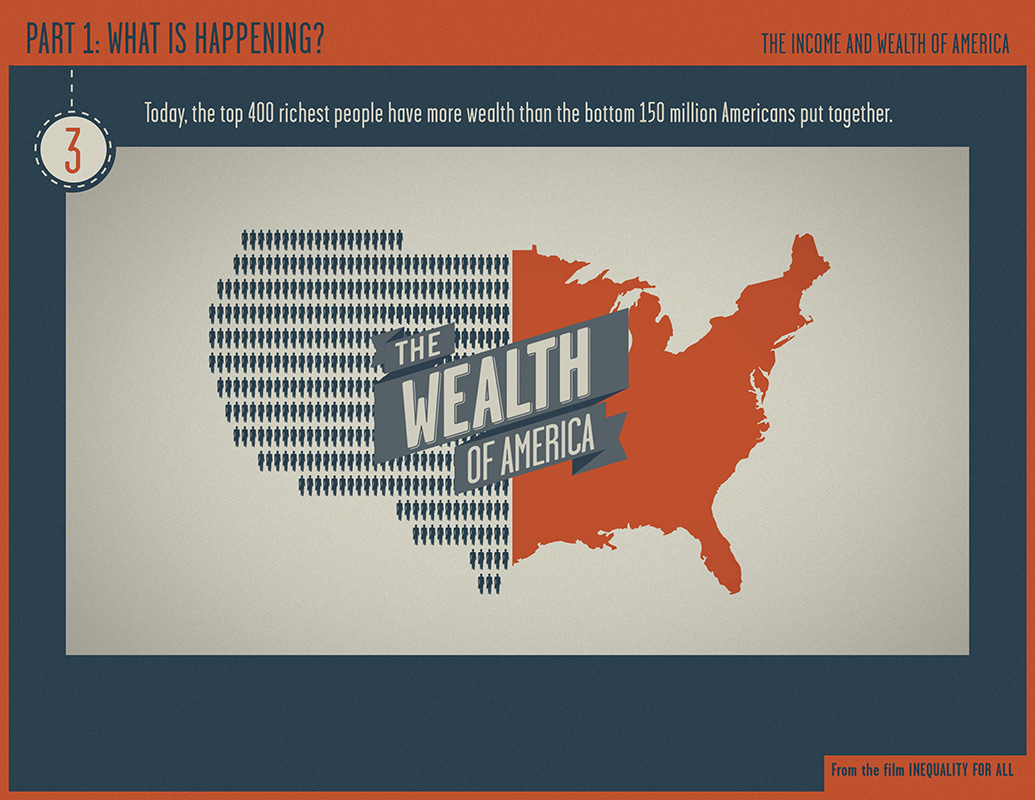

And billionaires have more resources to put into that pool — our common wealth — than anyone else does.

Although the words “millionaire” and “billionaire” differ only in their first character, there is an enormous difference between having a million dollar fortune and a billion dollar one, as author Chip Health explains in his book .

Senators, suppose for a moment that you all entered a special lottery with many large prizes. But there’s a catch: if you win, you have to spend $50,000 of your prize money every day until it runs out.

One of you wins a million dollars and one of you wins a billion.

How long does it take each of you to spend your winnings?

The one who wins a million will have finished spending their $50,000 per day after just twenty days.

But the one who wins a billion?

It’ll take them fifty-five years to spend $50,000 a day.

That’s how much a billion is. One billion dollars is an absolutely enormous amount of money, and many billionaires have well north of one billion.

Anyone with a billionaire fortune is financially secure for life, because as you heard, a billion dollars is so much that it’s hard to spend.

Consequently, billionaires are in a better position than anyone else to invest in Washington’s future. And the investments they make through their tax dollars will go towards priorities like ensuring that we have outstanding public schools, universities that lead in the world in fields like medical research, transit for all, seaports that provide freight mobility and living wage jobs, behavorial health services, and so much more.

It is to their benefit to live in a state that offers great schools, great jobs, great recreational opportunities, great healthcare, and great public services.

We invite you to join us in supporting a wealth tax on billionaire fortunes. It will make our tax code more equitable and strengthen our communities.

Thank you.