With the autumn equinox now well in the rearview mirror, the time is rapidly drawing near for county elections officials across Washington State to finish mailing out ballots for the November 2021 general election.

Ballots for military and overseas voters were mailed last month; the rest of the electorate should receive theirs around midway through the month.

Although there are no statewide measures (initiatives, referenda, or constitutional amendments) on this year’s ballot, voters will see three anti-tax propaganda pieces right at the top, presented duplicitously as “advisory votes.”

“Advisory votes” are a mid-2000s creation of propagandist Tim Eyman, a Trumplike local political figure who has spent much of his life trying to wreck government in Washington State because he is rabidly opposed to the American ideal of people pooling their resources to get things done.

Eyman has a gift for manipulating people, and has used that gift to peddle initiatives (proposed statewide laws that go on the ballot for people to vote on) that defund essential public services of all kinds, from trains and buses to schools, parks, ferries, hospitals, libraries, pools, and fire departments.

Eyman has also proposed various schemes to keep Washington State’s unfair, upside down tax code permanently rigged in favor of the wealthy, most of which have been invalidated by Washington’s courts as unconstitutional.

“Advisory votes” are a leftover remnant of one of those anti-tax schemes that have yet to be struck down in court or repealed by the Legislature. They are propaganda pieces that are automatically triggered whenever the Legislature takes any action that increases state revenue, which happens every year when budgets are written and approved for implementation by the executive branch.

Eyman created “advisory votes” because he wanted to use the ballot itself for anti-tax marketing purposes. Rather than paying for ads at election time like other entities in politics, Eyman wanted to create a system that would regularly enable his messaging to be presented to voters at no cost to him or his associates.

Effectively, this means that Eyman is guaranteed valuable ballot “real estate” every single year. And the cost is borne by taxpayers. Pretty ironic.

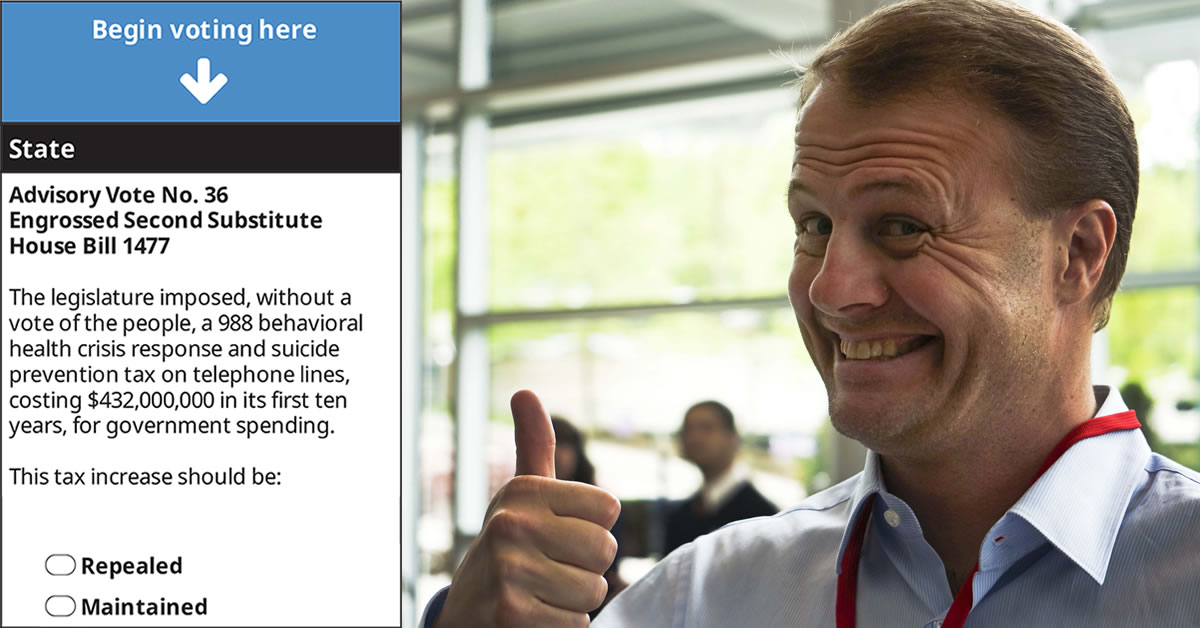

Each “advisory vote” pretends to ask Washingtonians whether they approve of a particular bill that the Legislature already passed that raises state revenue in some way.

Voters are then asked whether they want to “repeal” or “maintain” the bill, when in fact, their “votes” will have no effect and won’t change state law.

NPI has been working for years to get rid of “advisory votes,” because anti-tax propaganda does not belong on our ballots.

Senator Patty Kuderer (who represents NPI’s home legislative district in the Senate, the 48th) has been working with us on this effort for several years.

Senator Kuderer has sponsored a well-crafted bill, SB 5182, that would replace “advisory votes” with truthful and useful information about the Legislature’s fiscal decisions in the voter’s pamphlet, which is an appropriate place for such information.

SB 5182 is currently pending in the Senate (it received a vote of confidence in the State Senate’s State Government Committee) and is our top priority for next session.

Because we are in between sessions that are part of the same legislative biennium, the bill remains alive, and we continue to champion it as our top priority.

If SB 5182 gets a successful floor vote in the Senate, it could be considered by the House.

If the House approved it, it could then go to Governor Jay Inslee to be signed into law, and then “advisory votes” would be kaput starting in 2022. This would be the last year of them.

In the meantime, voters will see three “advisory votes” on their ballots this year, numbered #36, #37, and #38. Each “advisory vote” was triggered by a bill that raised revenue, with one of those bills being the state’s new capital gains tax on the wealthy. The three bills subjected to propaganda this year are:

- Engrossed Second Substitute House Bill 1477 (Implementing the national 988 system to enhance and expand behavioral health crisis response and suicide prevention services.)

- Engrossed Substitute Senate Bill 5096 (Concerning an excise tax on gains from the sale or exchange of certain capital assets.)

- Second Substitute Senate Bill 5315 (Concerning captive insurance.)

As in past years, the presence of these “advisory votes” will cause confusion and hinder many Washingtonians from efficiently filling out their ballots. That’s because many people naturally respond to something that confuses them by trying to obtain more information, whether by consulting a family member, calling elected officials, searching the Internet, or just turning it over in their heads.

Other Washingtonians may draw erroneous conclusions about what the three bills do based on the purposefully misleading language of the “advisory votes,” which Eyman designed to look and sound official, but which are, again, purely propaganda pieces that he designed to serve his own ideological agenda.

Every “advisory vote” is formulated using prejudicial language that encourages a “Repealed” vote. “Repealed” is even offered as the first option for voters to fill out rather than the second option (typically, on a ballot, “No” or “Rejected” is shown as the second option, and “Yes” or “Approved” is shown first).

Voters are also shown a ten year fiscal impact estimate rather than a one or two year one, which results in a larger, more impressive sounding number that Eyman can cite in his anti-tax missives. (Any revenue tally sounds more impressive when you take it out over ten years… but budgeting isn’t done in ten-year increments.)

Eyman has defended his publicly subsidized anti-tax propaganda generation scheme as good for democracy because it supposedly allows voters to “weigh in” on tax increases. This fiction has been picked up by reporters and editorial writers alike. For example, last week, in an article for the Spokesman-Review, Laurel Demkovich incorrectly characterized “advisory votes” this way:

Anytime the Legislature passes a tax increase, it’s placed on the ballot as an advisory vote. The votes don’t change the law, but they allow the public to voice their opinion on taxes passed in the Legislature.

Meanwhile, The Seattle Times ran an unsigned editorial on September 26th urging its readers to “send a message” to the Legislature that the capital gains tax is bad by voting “Repealed” on one of the “advisory votes”.

Advisory votes don’t repeal the law, but they do reveal public opinion about revenue-increasing legislation.

They are an artifact of a voter initiative requiring any legislative tax or fee increases to appear on the ballot. The least state lawmakers deserve for their premature maneuver is a collective thumbs down from the people they’re supposed to represent.

Like Eyman, The Seattle Times and Demkovich are wrong. “Advisory votes” do not allow people to “voice” or “reveal” their opinions about recent actions taken by the Legislature that increase revenue (which may or may not be tax increases).

That’s because the questions being asked of voters are not neutrally worded.

If you ask a question that suggests its own answer, whether in a poll, or a questionnaire, or on an official ballot, then you simply cannot find out what people really think. It’s just not possible. The ensuing “data” will be worthless.

“Advisory votes” violate every single rule for writing neutral questions, and that is by design. The prejudicial language is a feature, not a bug. These things were not created to measure public opinion; they were created to influence it.

In this way, they are like push polls… a marketing technique regularly employed by disreputable campaigns and interest groups.

To put it another way: Because “advisory votes” are themselves anti-tax messages, they cannot be used as a vehicle to “send a message” to legislators.

Lawmakers, in turn, are obligated as responsible representatives of the people to ignore/discard bad data such as that which “advisory votes” generate, and in the case of “advisory votes,” they have a history of consistently doing so.

Disconcertingly, even the state’s own election materials support the false impression that “advisory votes” were written by state officials.

Demkovich’s article characterizes the online voter’s guide as having “descriptions written by the attorney general’s office,” probably because the voter’s pamphlet itself statement falsely says: “Written by the Office of the Attorney General.”

However, this is not the case: the descriptions are actually set forth in statute with only a few blanks to be filled in by a state attorney.

In other words, the “advisory votes” have Eyman’s authorship, not the Attorney General’s. You can see this yourself by looking at RCW 29A.72.283. The language is explicitly hardcoded in there, with blanks for the insertion of numbers and an extremely short description of the bill to be subjected to anti-tax propaganda. Eyman wrote the statute and is thus the principal author of every single “advisory vote” that voters have ever seen going back ten years.

RCW 29A.72.283

Advisory vote on tax legislation — Short description.

Within five days of receipt of a measure for an advisory vote of the people from the secretary of state under RCW 29A.72.040 the attorney general shall formulate a short description not exceeding thirty-three words and not subject to appeal, of each tax increase and shall transmit a certified copy of such short description meeting the requirements of this section to the secretary of state. The description must be formulated and displayed on the ballot substantially as follows:

“The legislature imposed, without a vote of the people, (identification of tax and description of increase), costing (most up-to-date ten-year cost projection, expressed in dollars and rounded to the nearest million) in its first ten years, for government spending. This tax increase should be:

Repealed .… [ ]

Maintained .…[ ]”Saturdays, Sundays, and legal holidays are not counted in calculating the time limits in this section.

The words “This tax increase should be: Repealed … [ ] Maintained … [ ]” are not counted in the thirty-three word limit for a short description under this section.

Emphasis above is mine.

Our team at NPI regards “advisory votes” as a form of voter suppression because they confuse voters and interrupt the act of voting. They are a cancer on our ballots. They need to be abolished. We are committed to getting Senate Bill 5182 passed to replace them with useful, truthful information in the voter’s pamphlet, and we hope to have Cascadia Advocate readers’ help in doing so.

Voters who want to express their view on ESSB 5096 or any other bill enacted by the Legislature during the past session should write to their legislators and engage in a dialogue with them… or sign up to participate in an online tax study town hall to be part of a larger conversation about the state’s tax code. The Legislature is holding several of those this month. They’re open to the public and we encourage you to attend. You can obtain the schedule and RSVP here.

Comments are closed.