About two months ago, the early returns in the November 2019 general election indicated that Tim Eyman’s incredibly destructive Initiative 976 would pass, setting in motion an urgent and heated discussion about the future of transportation funding in Washington State. I‑976 ultimately did pass, with 52.99% of the 45.19% of Washingtonians who turned out voting yes, and 47.01% voting no.

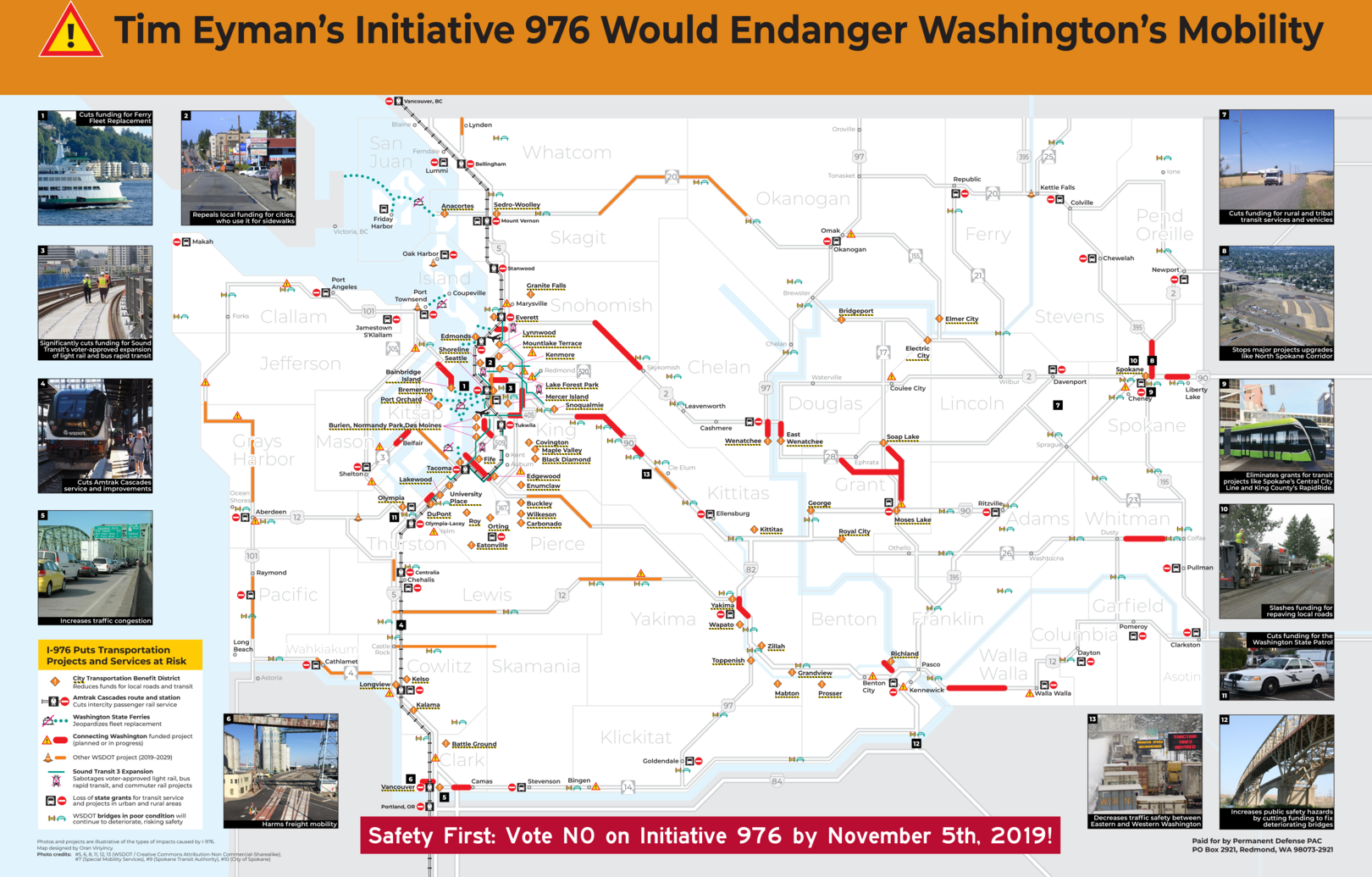

The objective of Eyman’s I‑976 was to repeal billions in bipartisan, voter-approved transportation funding at three levels (state, regional, and local), with the aim of eliminating funding for all non-highway modes of transportation.

The measure is currently on hold as a result of a court-ordered injunction, but that hasn’t stopped Republican lawmakers from arguing that it should be implemented (perhaps legislatively) anyway. Of course, implementing I‑976 would wreck the fiscal foundation of the state’s transportation system, resulting in the cancellation or delay of a long list of projects, including highway projects.

Republican lawmakers know that budgets cannot be balanced using Tim Eyman talking points. Public services cost money, and money has to come from somewhere. So they’re disingenuously proposing to divert funding from schools, mental health, and other essential public services to make up the shortfall in the transportation budget that would result from the implementation of I‑976.

In a piece ironically titled “Beyond I‑976: We need a better way to fund highway projects,” Republican Senator Curtis King of Yakima argues:

Some of my Senate colleagues are offering a sensible long-term solution for Washington’s transportation needs — shifting the state sales-tax revenue from vehicle purchases into the state transportation budget over several biennium instead of continuing to put it in the state operating budget. The operating budget has seen huge increases in revenues, up 17% this biennium alone.

It’s logical, given the relationship between vehicles and transportation infrastructure, and would allow lawmakers to maintain and increase transportation investments without adding a tax. That sounds like an approach the voters would appreciate.

Robbing Peter to pay Paul is neither logical nor an approach that the voters will appreciate. A clear majority of 56% of likely 2019 Washington voters surveyed by NPI’s pollster Public Policy Polling after the conclusion of last year’s legislative session in May said that they agreed that Washington’s public schools were underfunded, and that state revenue needed to be raised to fully fund them.

This was after the Legislature had adjourned on April 28th having passed several modest revenue reforms that increased funding for our essential public services.

Public schools and higher education make up the majority of expenditures supported by the state’s general fund, which the state sales tax is the primary source of revenue for. So what Republicans are really doing here is proposing raiding education funding so that they can have cheap vehicle fees and highway projects.

The education of our youth is our state’s paramount duty — the Constitution is very clear about this — but Republicans do not care. Their priority is their cars. Not our kids, who are our future. Nope, gotta put our cars first and perpetuate our culture of auto dependence. Nothing is too good for our cars!

Governor Inslee has justifiably dismissed this bad idea already, telling reporters at his budget rollout press conference last month that it would be irresponsible.

But the absurdity of this proposal actually goes even deeper.

See, Initiative 976 didn’t just target vehicle fees for repeal.… it also targeted for repeal a portion of the sales tax on motor vehicles. Yes, the very revenue source Republicans like Curtis King are talking about relying on to get us “beyond I‑976” was among the taxes and fees that Eyman targeted with I‑976!

You’d be forgiven for not knowing this if you weren’t aware, because it was not mentioned in the ballot title or the voter’s pamphlet statement arguments section.

But if you read the text of the initiative, or the fiscal impact statement, you can see that the measure does in fact attempt to repeal more than just vehicle fees.

Section 7 of I‑976 repeals the following portion of RCW 82.08.020:

(3) Beginning July 1, 2003, there is levied and collected an additional tax of three-tenths of one percent of the selling price on each retail sale of a motor vehicle in this state, other than retail car rentals taxed under subsection (2) of this section. The revenue collected under this subsection must be deposited in the multimodal transportation account created in RCW 47.66.070.(4) For purposes of subsection (3) of this section, “motor vehicle” has the meaning provided in RCW 46.04.320, but does not include:(a) Farm tractors or farm vehicles as defined in RCW 46.04.180 and 46.04.181, unless the farm tractor or farm vehicle is for use in the production of marijuana;(b) Off-road vehicles as defined in RCW 46.04.365;(c) Nonhighway vehicles as defined in RCW 46.09.310; and(d) Snowmobiles as defined in RCW 46.04.546.

The reason why Eyman targeted this portion of the sales tax on motor vehicles for repeal along with vehicle fees at the state, regional, and local levels is simple: His objective with I‑976 was to destroy funding for non-highway modes. “Thirty dollar car tabs” was his slogan, but it was a smokescreen.

The real objective of I‑976 was to devastate funding for transit, bike paths, sidewalks, and even local roads, because Eyman is ideologically opposed to tax dollars going to any transportation purpose except for highways.

Notice in the excerpt above that it says “the revenue collected under this subsection must be deposited in the multimodal transportation account.”

That multimodal account, as its name suggests, benefits all transportation modes, not just highways. And that’s why Eyman targeted it. With I‑976, he wanted to do as much damage as he could to multimodal infrastructure in one fell swoop.

It matters not to Eyman that his “thirty dollar car tabs” slogan is a lie, as his real aim was — and is — to defund transit and people-oriented transportation infrastructure.

It is crucial that everyone in Washington understand this, which is why I’m choosing to be repetitive here and restate this important point several times. Cheap car tabs are merely a side effect of Tim Eyman’s real agenda.

When The News Tribune asked Eyman about the fact that I‑976 would not actually reduce vehicle fees to thirty dollars like it promised, Eyman’s response was essentially to shrug… because he really and truly doesn’t care.

He admitted, on the record, that I‑976 doesn’t do what it claims to do.

DOL said the initiative did not repeal the following:

- $8 service fee, which goes to the office that processes the transaction or to fund state ferry replacements if car tabs are renewed at a county auditor or at the DOL.

- $4.50 filing fee, which is kept by the county in which the car tab tax is paid.

- 50 cent DOL license service fee, which is used to support its computer system and reimbursement of county licensing activities.

- 25 cent license plate technology fee, which also is used to pay for DOL computer work to charge the car tab.

The total: $43.25.

Eyman agrees.

“We were going after the big ones, the big guys. The fee itself is $30. There are some ancillary fees on there,” he said.

The initiative eliminates the additional fee the state charges based on the weight of a vehicle, which can range from $25 to $65. It also bars local governments from tacking on car tab fees through transportation benefit districts.

Eyman said he doesn’t see a problem because the initiative will cut car tabs substantially by eliminating the weight fees and targeting Sound Transit’s MVET, which is collected in the urban areas of Pierce, King and Snohomish counties.

“Are voters going to be furious because it’s $43? I don’t think so.”

Only 23.44% of the registered voters of Washington State voted for Tim Eyman’s Initiative 976. Most voters either voted no or did not express an opinion one way or the other. Nevertheless, Republican lawmakers are pressing for this submajority’s will to be honored. They want I‑976 implemented. But of course, that would mean cutting the sales tax on motor vehicles along with vehicle fees.

How much revenue would be lost? Hundreds of millions by the end of the 2020s. The sales tax on motor vehicles is projected to raise $109.62 million during the 2019–2021 biennium, according to the state’s Transportation Resource Manual.

Transportation Resource Manual extract: Retail sales tax on motor vehiclesIf you’re going to argue that vehicle fees have become revenue non grata in the wake of I‑976’s passage, then the same goes for the retail sales tax on motor vehicles. The people who voted for “thirty dollar car tabs” also voted to cut the portion of the sales tax on motor vehicles that goes to transportation.

Section 7 is as much a part of Initiative 976 as any of the measure’s other sections.

And yet Curtis King and other Republicans are out there saying we should use revenue from the sales tax on motor vehicles to fund transportation.

To be clear, the revenue they want to divert is the portion that’s going to the general fund, not the portion I‑976 is trying to repeal. But by their logic, the voters just said we don’t want to fund transportation projects with sales tax dollars.

So, on the one hand, they’re arguing that we should abide by the will of the group of voters who backed I‑976, and on the other hand, they are simultaneously arguing that we should not abide by the will of that very same group of voters.

It’s good to know they’re not sincere when they talk about the will of the voters.

To truly move beyond I‑976, it’s important that lawmakers first recognize that it was a scam and a con perpetrated against the voters of Washington State.

I‑976’s ballot title contained multiple falsehoods (including the false promise of “thirty dollar car tabs”, as mentioned above) and no mention or even allusion to the destructive consequences of its implementation.

The result therefore cannot be regarded as a useful measurement of where people stand on how transportation in this state ought to be funded.

Because the I‑976 ballot title is a blazing dumpster fire, about the only conclusion we can draw from the I‑976 result is that there are a significant number of people who would like vehicle fees to be lowered or assessed in a more equitable way (or both). We can make this inference in part because it is supported by other available data, including credible public opinion research on the subject.

Instead of repealing vehicle fees left and right as Eyman proposed, the Legislature should restructure them and ensure low income families benefit in the process.

The Legislature fortunately possesses the power to responsibly rewrite the tax code. It is probable that I‑976 will ultimately fail to withstand constitutional scrutiny in the courts, which is why the Legislature had best start preparing for that scenario with a plan that addresses the grievances of people who are frustrated about vehicle fees but also want transportation projects funded and built — an outcome that will not be possible if I‑976 is implemented as Tim Eyman intended.

This is the best idea Curtis King can come up with?