Today, we’re beginning a new series on The Advocate called Flashback to the Bush Error that will feature new installments on Fridays each week through Election Day. The purpose of this series is to document and explore Paul Ryan and Mitt Romney’s support for the failed policies of George W. Bush during the eight years that Bush was in power (January 2001 — January 2009).

Philosopher George Santayana once reflected that those who cannot remember the past are condemned to repeat it. Given how short our attention spans seem to be these days, we think it’s worth remembering what happened to our country prior to President Obama’s accession to power in the historic presidential election of 2008.

Our hope is that this series helps illustrate differences between the campaign platforms of Barack Obama/Joe Biden and Mitt Romney/Paul Ryan, which are quite stark. The traditional media spends way too much ink, airtime, and pixels doing horse-race style political coverage (who’s winning, who’s losing). We’re going to do our best to steer the conversation in a different direction.

In this first installment, we’ll be delving into Paul Ryan’s record on fiscal matters.

Ryan and his admirers have long portrayed him as a principled man who is very concerned about our ability to “live within our means”, which is a favorite maxim of conservatives. In reality, Ryan deserves a healthy percentage of the blame for the mess that we’re in as a country. Let’s begin with some context.

Paul Ryan was first elected to the U.S. House of Representatives in 1998, during the second midterm elections of Bill Clinton’s presidency. (That was the same year Jay Inslee returned to Congress in Washington State).

At the time he was sworn in, he was the second youngest member of the House of Representatives. It wasn’t long before House Republican leadership assigned him to the Committee on Ways and Means.

As I alluded to above, in 2001, Ryan was an enthusiastic supporter of George W. Bush’s proposal to slash federal income taxes, especially for the wealthy. In debates on the House floor, he stuck to his assigned talking points when given an opportunity to weigh in on the merits (or lack thereof) of the tax cuts:

Mr. Speaker, I thank the chairman for yielding me this time. I have been listening to this debate with a lot of wonder. I am a newer member to the committee and a newer Member to Congress. It is amazing to me the excuses we are hearing to further separate people from their own money. We hear that this tax cut is just too big, it is irresponsible, we cannot handle it. I refer Members to this chart which shows that this is six cents on the dollar, six cents on the dollar that every American taxpayer is sending to Washington over the next ten years. $1.6 trillion out of $28 trillion.

— Paul Ryan, March 8th, 2001 (Source: Congressional Record)

Two months later, Ryan again urged passage of the Economic Growth and Tax Relief Reconciliation Act of 2001, claiming it would lead to broader prosperity:

We are paying down the national debt as fast as we can. And even after doing all of those things, you are still overpaying your taxes. What we are simply saying is rather than take your money and find new ways to spend it for you here in Washington, we want to give it back to the American people, put the money back into their paychecks as they overpay their taxes, and revive this engine of economic growth, small businesses and entrepreneurs, and prey on people’s hopes and dreams and aspirations. That is what this all about.

— Paul Ryan, May 16th, 2001 (Source: Congressional Record)

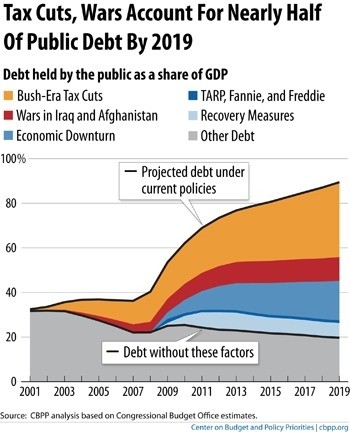

Of course, by the end of the Bush years, the national debt had skyrocketed as a result of years of deficit spending, job losses were mounting by the month, and income inequality had reached a disturbing new high.

Ryan was not the only one claiming that the Bush tax cuts would do wonders for the economy.

The conservative Heritage Foundation went so far as to explicitly predict that passage of the Bush tax cuts would “effectively” result in the elimination of the national debt by 2010. Republicans promised the the people of the United States that slashing taxes would be the greatest possible thing for the economy and was a fiscally sensible course of action.

They were dead wrong then, and they’re dead wrong now.

Paul Ryan and Mitt Romney want to return us to the Bush error. They’ve tried to avoid sounding like apologists for Bush on the campaign trail, because they don’t want to be associated with one of the most unpopular presidents in American history. But the reality is, they want to pick up where Dubya left off. They want to return us to the same failed policies that wrecked our economy and cost us our moral authority around the world. We can’t afford that.

Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote Vote 44444MoreeeeYearssssss.…

Well said, sir. We haven’t cleaned up the mess from the last elephant we let in our house. No way, do we want another elephant fouling our entire country again. Vote or get trampled!