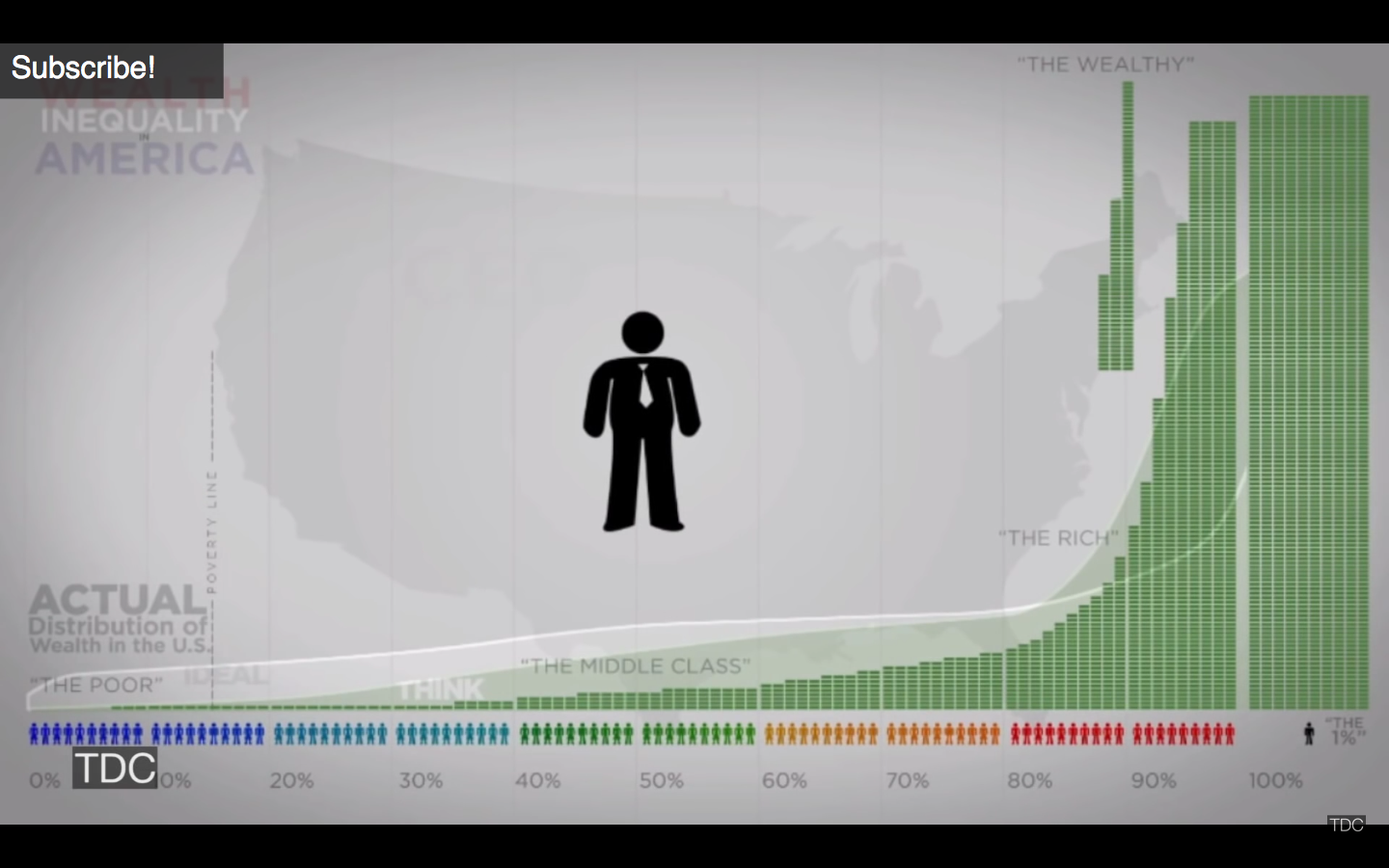

The Los Angeles Times’ David Lauter reports: “Many of the nation’s richest people said after the January 6th, 2021, attack on the U.S. Capitol that they would never again back former President Trump. Now, they’re changing their minds.”

Launch

Offering asides, recommended links, blogworthy quotations, and more, In Brief is the Northwest Progressive Institute's microblog of world, national, and local politics.

The Los Angeles Times’ David Lauter reports: “Many of the nation’s richest people said after the January 6th, 2021, attack on the U.S. Capitol that they would never again back former President Trump. Now, they’re changing their minds.”

Launch

Ultra MAGA lackeys of Donald Trump who currently control the United States House of Representatives want to force the Senate and the Biden administration to reverse the investments made to Amtrak and clean drinking water infrastructure as part of the Infrastructure Investment and Jobs Act, which is unacceptable to Democrats.

Launch

Jonathan Levin of Bloomberg explains why a billionaire’s decision to symbolically move his firm’s headquarters is not actually about taxes, despite his grandstanding.

Launch

Read this Washington Post article about IRS preparations for “a normal tax season,” made possible by the Inflation Reduction Act that was passed into law solely with Democratic votes.

Launch

Watch the speaking program of the January 26th, 2023 rally to support our state’s capital gains tax on the wealthy organized by Invest in Washington Now.

Launch

“Has the worst of the pandemic-induced inflation already passed? The latest economic data released this week suggest so. That leaves Republicans in a quandary,” Jennifer Rubin writes.

Launch

“Repealing capital gains tax would give King County’s uber wealthy a huge, unnecessary tax break,” explains Washington State Budget & Policy Center senior fellow Andy Nicholas.

Launch

“Sanders, just weeks from his eightieth birthday, is on the cusp of leaving an indelible mark on the federal government, having shepherded a $3.5 trillion spending blueprint through the Senate this week,” The Washington Post’s Mike DeBonis reports.

Launch

ProPublica reports it that has obtained a vast cache of IRS information showing how billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth — sometimes, even nothing.

Launch

Imagine if Tim Eyman became governor and began taking an axe to Washington’s public services. That’s what is happening in Alaska, where right wing extremist Mike Dunleavy is using his line item veto power to force through a 41% cut to the University of Alaska system, plus gut Medicaid, behavioral health, and the Alaska State Ferry system.

Launch

“Fully 60% of millionaires support Warren’s plan for taxing the wealth of those who have more than $50 million in assets,” CNBC reports.

Launch

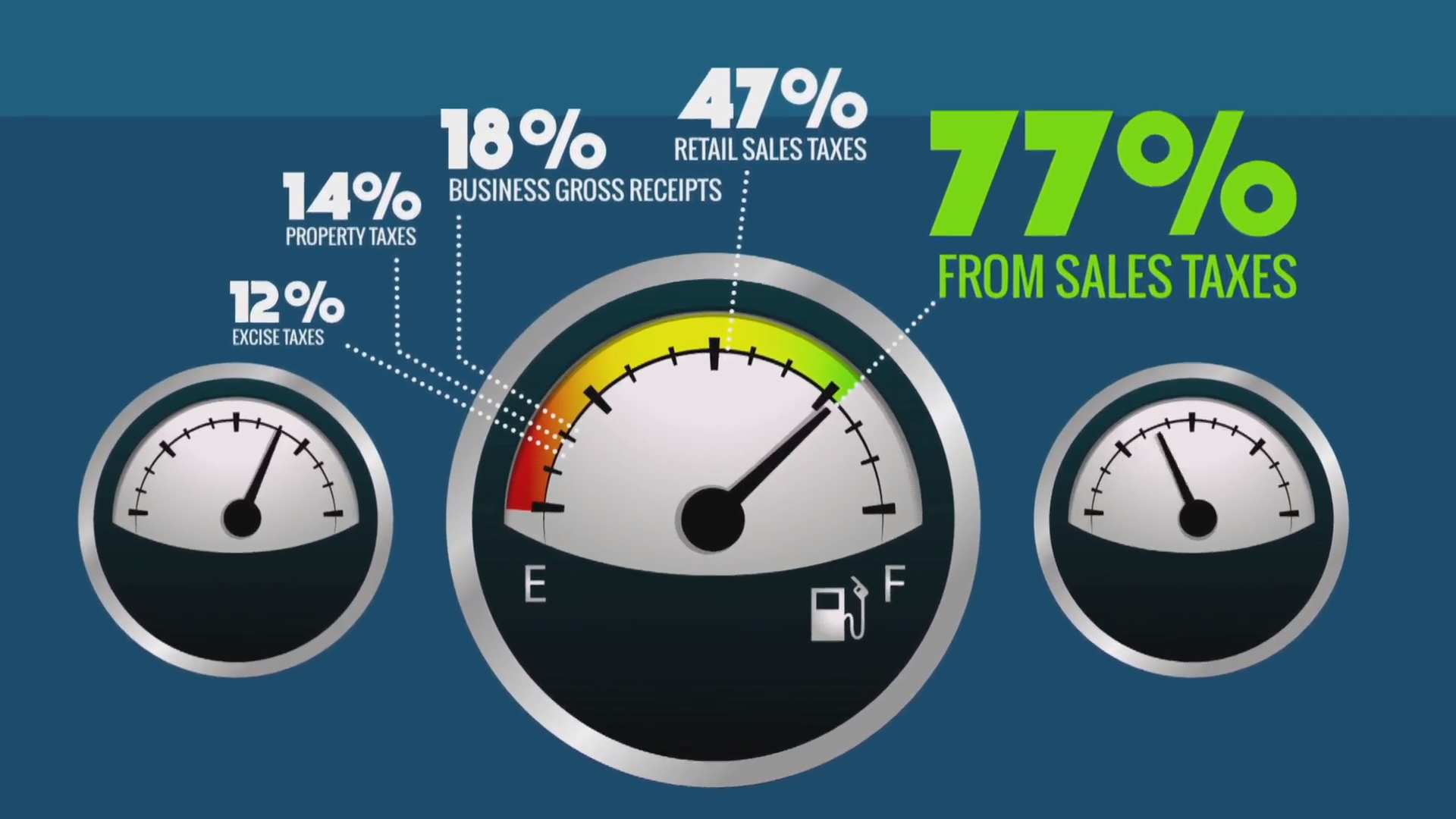

KCTS9: What’s Up With Washington State’s Tax System? Washington state’s vibrant and diverse economy doesn’t hint at it. Neither does Seattle’s red-hot construction and tech

Launch

Interstate 84, Oregon’s main east-west link, is closed indefinitely in stretches between Hood River and The Dalles due to the Eagle Creek Fire and unstable slopes produced by the fire. That’s hurting truckers like David Cassidy, whose livelihood is made possible by the availability of public infrastructure paid for by taxpayers.

Launch

Congresswoman Pramila Jayapal questioned Budget Director Mick Mulvaney about Trump’s new budget proposal during the House Budget Committee hearing today. Watch the video and read the transcript.

Launch

Southwestern Oregon’s public services are rotting away or shutting down due to voter unwillingness to pay dues to keep them running. The New York Times looks at the collapse of the commons in an often-ignored area of the Pacific Northwest.

Launch

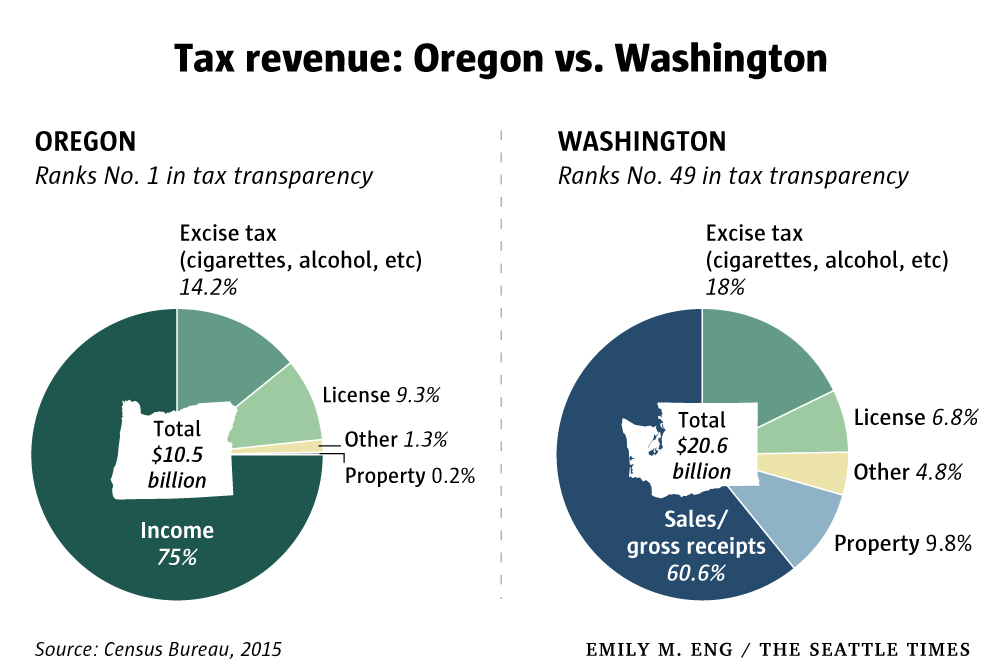

“Ranked second from the bottom in a new report, the state’s tax system makes it tough for taxpayers to find out just how much they’re coughing up to the government. Oregon’s system ranks as the most transparent of all,” writes The Seattle Times’ Gene Balk.

Launch

What happens when a vital public service is starved of resources? It shuts down. Without enough funding to keep the doors open, authorities in Oregon’s Douglas County are closing its libraries, leaving 8,500 cardholders stranded. “We simply don’t have the money anymore,” Douglas County Commissioner Gary Leif told The Register Guard of Eugene.

Launch

“Since the 2008 financial crisis, private equity firms have increasingly taken over public services like emergency care and firefighting, often with dire effects,” The New York Times reports.

Launch

Drill, baby, drill. For years, that silly slogan has been a part of the Republican lexicon. But now, with global oil prices tumbling due to excess supply (caused in part by the North American oil boom), fossil fuel-dependent Alaska finds itself in a huge fiscal morass. Independent Governor Bill Walker, a former Republican, has proposed reinstituting a state income tax to ensure that the state can continue to provide public services to its citizens.

Launch

I was so tired of partisan politics. It was all Tim Eyman and no new taxes… That’s not me. I’m interested in community building. —

LaunchSurprise! The rich benefit the most from tax breaks intend to help people build wealth Bloomberg reports that most of the public money spent to

Launch