Defeat 1098's message is built on recycled, shameless scare tactics from the 1970s

And sure enough, it didn't take long for the state's establishment to get spooked. The Seattle Times has editorialized monthly against I-1098, many of Washington's richest denizens have showed their true colors by donating to Defeat 1098 (including some who have previously gone on record in support of investing in stronger schools), and now the state's biggest corporations (Microsoft, Boeing, Amazon, et al.) have announced their opposition.

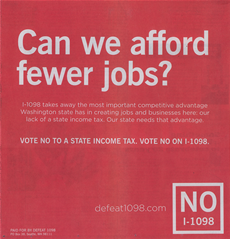

The campaign against the initiative, with the support of the Blethen family, has been placing a lot of ads in the Seattle Times urging voters to vote no. The ads, which consist of white wording against a red background, are designed to sow as many seeds of doubt as possible in voters' minds (which is the objective of the typical ballot measure opposition campaign).

What made an impression on me, however, was the similarity to the ads I saw while I was researching the Seattle Times' position on tax reform in the 1970s. See for yourself... here's an ad from the campaign against HJR 42 in 1970, and a modern day ad from "Defeat 1098":

Click on the thumbnails to see full-size images. The thumbnail to the left depicts an ad than ran against HJR 42 (a constitutional amendment to create an income tax) in the Seattle Times on October 31st, 2010. The thumbnail to the top-right depicts an ad against Initiative 1098 that ran a couple of days ago.

Notice anything similar?

I was particularly amused by one of the last lines in the 1970 ad: HJR 42 won't bring new jobs and payrolls to the state — IT WILL SCARE THEM AWAY.

That's the same thing opponents of Initiative 1098 are saying today.

What's really scary is that our state is home to so many unpatriotic hypocrites. They talk about wanting to be competitive in a global economy, and needing great public services and infrastructure (particularly outstanding public schools) to do that. But they don't walk their talk. They refuse to be role-models or leaders. Instead, they act like greedy, self-obsessed misers.

They feel that their own wealth is more important than the common wealth.

They're so frightened at the prospect of having to pay their fair share that they're trying to dupe the rest of us into thinking that I-1098 threatens our economic security, when in fact it greatly benefits our economic security.

Only four other states besides Washington levy no income tax at all: Wyoming, Nevada, Texas, and South Dakota.

Every other state levies either a personal income tax, corporate income tax, or both. Income taxes are collected in each of our neighboring states (Idaho and Oregon), as well as in most of the states that border those states.

This notion that there's going to be a mass exodus if I-1098 passes is nonsense. Opponents know that the income tax imposed by I-1098 will only fall on families who easily have the means to pay it, and are currently paying less (as a percentage) than lower and middle income families are in membership dues to our state.

But if they admit that, then they're basically making a case for the initiative.

So they are forced to resort to shameless scare tactics. They laughably claim that the Legislature will quickly levy an income tax on everybody if I-1098 passes. The Legislature will do no such thing. There may come a day in the distant future when the Legislature musters the courage to do away with most or all of the sales tax and replace it with a general personal income tax, but then the matter would be probably put before the people to decide.

Anybody who has lobbied for change in Olympia knows that the Legislature is a risk-averse institution. Legislators are good at dithering (also known as procrastination, or putting off difficult problems). That's why I-1098 is on our ballots. Public interest activists got tired of waiting for the Legislature to do something about our broken tax system, and wanted to give the people of Washington a chance to move us forward.

In January, Oregonians voted to raise the marginal tax rate on household personal income above $250,000 by 1.8%. They also voted to raise the $10 corporate minimum income tax for the first time since 1931, and the marginal tax rate on corporate profits by 1.3%. It's been several months since Measures 66 and 67 passed, and Oregon's doing just fine. In fact, it's doing better than it otherwise would be. Without the new revenue raised by Measures 66 and 67, the Legislature would have had to make more painful cuts.

Likewise, we're going to be in big trouble in the next biennium without I-1098, and without the defeat of the five other initiatives on Washington's ballot, which would only make our budget shortfall harder to responsibly close.

Vote YES on I-1098. Strengthen Washington's common wealth and let the misers behind the shameless opposition campaign know they can't buy your vote.

Comments:

Does it NEVER occur to you and your ilk to control spending?? Perhaps there are as many jobs in Washington as there are today because the earlier campaigns to stop the income tax SUCCEEDED! Your whining screed calling opposition to this huge tax increase "Selfish" or "Greedy" is strictly based on envy. It's always easy to give away OTHER people's money.

As a Washington small business operator - one of the newly designated "RICH" everybody seems to want to tax these days - I'm completely opposed to this ridiculous tax proposal. I'd rather hire more employees and buy more inventory than send more money to the cash sucking black hole in Olympia. Make no mistake, while the initial limits are high, once in place this will morph into a full scale income tax all the way down to ordinary folks. Once they get the snout of their tax camel under the tent it will be all over. And don't think for a minute they won't raid the "lockbox" like they have done for every other so called "dedicated" revenue source like lottery proceeds.

Washington is one of the few refuges left where taxes are based more on consumption and real property ownership rather than income. Let's not screw it up, particularly for this flimsily veiled play for all of our wallets.

!!VOTE NO ON 1098!!

To Timothy - taxes based on income are the fairest of all. You pay sales taxes and proprty taxes regardless of whether you have income or a job. I-1098 only starts the tax for income above $200,000 for an individual and $400,000 for a couple.

Your comment of hiring more employees and buying more inventory is exactly what you can do if you are making over $200,000 or $400,000 and don't what to pay the small amount of additional tax. It's called business expenses. Money spent for inventory or paying workers obviously is an expense and you won't be paying taxes on it.

To Steve - you're kidding, right? You only pay sales tax if you buy stuff. You only pay property tax if you own real property. And forget $200/$400K - you're focused on the wrong thing. While this proposition starts out with individuals/couples over $200K/$400K paying, read the proposition: EVERY WASHINGTON RESIDENT WILL STILL HAVE TO FILE AN INCOME TAX RETURN EVEN IF THEY DON'T HAVE TO PAY. And after two years the legislature - hardly a bastion of fiscal self restraint - can change the rates and limits at will!! Once Olympia gets permission and the infrastructure in place to process those returns, cranking the limits down to meet the next "emergency" will be easy to do. Eventually, Washington will end up like Oregon - except we'll still have the high sales tax! The only solution to getting the excess spending stopped is to starve the beast by cutting off the food supply.

And BTW, money spent buying increased inventory is NOT tax deductible - only the cost of inventory actually sold.

!!VOTE NO ON 1098!!

Post a Comment