Heck hath no fury like an economist scorned

The projected long-term growth rate in state General Fund revenue is built on little more than hope and a fuzzy trend line. At the end of the day, it still comes up short.

Look, if we're going to base revenue projections on inflation, let's use the same inflation for our expenditures. We don't. (Actually, we should work outside inflation entirely, if possible.) If we are using historical growth trends, let's use ones of recent vintage. And personal income is better used to mark a personal income tax. A sales/B&O/property mix should use median income. Median income is stagnating.

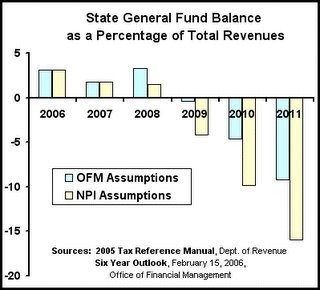

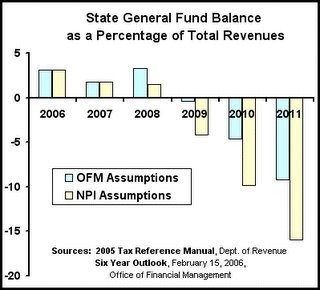

Here's the chart again.

Here's the chart again.

Even if revenues come in under OFM's official figures, we'd still be 10 percent short in five years. That is, revenues need to grow at 7% just to make a balanced budget. They will grow about half that fast, excluding untoward inflation or population influxes that will bring costs along with their revenue.

In the absence of tax reform (and there seems to be an absence of tax reform), the choices are minimal if we want to remain somewhat civilized here in the state. The best one is to create a comprehensive health care system. Major costs coming up are related to health care, both for employees and for clients of the state's systems. Many of these are off the General Fund budget, but many are not.

Irv Lefberg is the state Office of Financial Management (OFM) chief forecaster. You may remember a post in which I was taking Irv to task for saying the underlying rate of growth in state revenues was 5% when it wasn't, and for picking 90% of personal income growth as a measure, when personal income has little to do with our tax yields. The actual experience of the past ten yeiers has been under 4% and dropping in the big three -- Retail Sales, B&O and Property.Bazz Fazz. Phooey.

Irv answered that the underlying growth rate is 5%, they expect it to be in the future, and besides which the Office of Forecast Council and Chang Mook Sohn agreed. And he sent me a spreadsheet on the legislative changes that have been made since 1993, the implication being, I guess, that if the legislature stops cutting taxes here and there, the growth rate will appear from the mist as 5%.

I sent the e-mail: Irv, I am still puzzled. Maybe I didn't ask the right question. Let me try this one. Are state tax revenues projected to rise by five percent per year in the absence of legislative action? Thanks. AlanSince then, the freeze, the dark night of space, the great silence. Up until this point, we had a pretty good thing going. I would ask questions, and he would respond by annotating each in blue. Now I feel rejected. I suppose it's possible that he doesn't want to go on record saying the legislature has to do something to generate the historical trend. I don't know. I'm confused and angry.

Look, if we're going to base revenue projections on inflation, let's use the same inflation for our expenditures. We don't. (Actually, we should work outside inflation entirely, if possible.) If we are using historical growth trends, let's use ones of recent vintage. And personal income is better used to mark a personal income tax. A sales/B&O/property mix should use median income. Median income is stagnating.

Here's the chart again.

Here's the chart again.Even if revenues come in under OFM's official figures, we'd still be 10 percent short in five years. That is, revenues need to grow at 7% just to make a balanced budget. They will grow about half that fast, excluding untoward inflation or population influxes that will bring costs along with their revenue.

In the absence of tax reform (and there seems to be an absence of tax reform), the choices are minimal if we want to remain somewhat civilized here in the state. The best one is to create a comprehensive health care system. Major costs coming up are related to health care, both for employees and for clients of the state's systems. Many of these are off the General Fund budget, but many are not.