6-Year Outlook sees General Fund deficit

While the short-term state budget got another $160 million bump last week, the longer term is not so rosy, particularly if we apply some realistic assumptions to revenue projections.

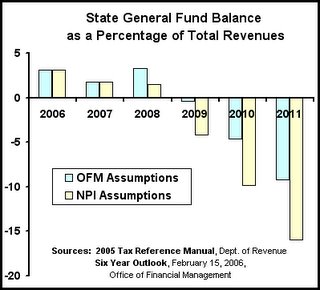

On Wednesday last, the Office of Financial Management and the chief state revenue forecaster Chang Mook Sohn announced an upward revision of $158.9 million to the current biennial budget. On the same day OFM released its new Six Year Outlook. That report incorporates the latest legislative actions into projections of fund balances out to 2011.

The official numbers put the state's general fund in a $1.5 billion hole in 2011. That's 10 percent of annual revenue. My alternative assumptions deepen that hole to $2.6 billion, 16 percent of revenue. (see chart) And both of us are too optimistic.

Wherein lie the differences? Mine are in the assumptions for revenue growth. OFM sees a 2.2 percent increase in '07, then increases of 5.7, 5.5, 5.0 and 5.0 percent in succeeding years.

Wherein lie the differences? Mine are in the assumptions for revenue growth. OFM sees a 2.2 percent increase in '07, then increases of 5.7, 5.5, 5.0 and 5.0 percent in succeeding years.

I have instead taken a rough weighted moving average of the historic increases for the major taxes -- Sales, B&O and property -- and applied it to the top line revenue number and extended it into 2008 and succeeding years.

For the sake of drama on this very dull stage, and even though some people are answering their phone on President's day, I'm publishing it here before I hear back from OFM. Maybe the burgeoning expenses of health programs come with a federal check. Maybe the inflation numbers make more difference than I think. I'll give you the verdict next week.

The Sales Tax provides roughly one-third of General Fund revenues. Federal grants are slightly less, but still close to one-third. All other taxes and fees comprise the other third. Of this last portion, the greatest contribution, about a third of the third, comes from the B&O Tax. The state's portion of the Property Tax amounts to a fourth of that third. And the remaining revenue sources make up the last ... let's see ... five-twelfths of the third (about 11 percent of total revenues).

All of which means: As goes the Sales Tax, so goes the revenue stream. Sales Taxes averaged a 4.1 percent increase 1995-2004, but the last five-plus percent was in 2000.

Why are even my assumptions too optimistic? First, because I accept OFM's for the first two years. Second, in the absence of regime change, federal grants will increase less than federal mandates. Third, I allow the Sales Tax rate increases of the past ten years into my average as if they were simple increases in economic activity. In fact, the Sales Tax is under downward pressure from Internet sales and will also suffer along with the Property Tax when housing cools off. (It will suffer not only because the purchase of home furnishings will slow, but also from the loss of the construction labor input, which is taxed under the Sales Tax.)

The good news? The next biennium is in balance, thanks to the set-asides from this year's surplus.

On Wednesday last, the Office of Financial Management and the chief state revenue forecaster Chang Mook Sohn announced an upward revision of $158.9 million to the current biennial budget. On the same day OFM released its new Six Year Outlook. That report incorporates the latest legislative actions into projections of fund balances out to 2011.

The official numbers put the state's general fund in a $1.5 billion hole in 2011. That's 10 percent of annual revenue. My alternative assumptions deepen that hole to $2.6 billion, 16 percent of revenue. (see chart) And both of us are too optimistic.

Wherein lie the differences? Mine are in the assumptions for revenue growth. OFM sees a 2.2 percent increase in '07, then increases of 5.7, 5.5, 5.0 and 5.0 percent in succeeding years.

Wherein lie the differences? Mine are in the assumptions for revenue growth. OFM sees a 2.2 percent increase in '07, then increases of 5.7, 5.5, 5.0 and 5.0 percent in succeeding years. I have instead taken a rough weighted moving average of the historic increases for the major taxes -- Sales, B&O and property -- and applied it to the top line revenue number and extended it into 2008 and succeeding years.

For the sake of drama on this very dull stage, and even though some people are answering their phone on President's day, I'm publishing it here before I hear back from OFM. Maybe the burgeoning expenses of health programs come with a federal check. Maybe the inflation numbers make more difference than I think. I'll give you the verdict next week.

The Sales Tax provides roughly one-third of General Fund revenues. Federal grants are slightly less, but still close to one-third. All other taxes and fees comprise the other third. Of this last portion, the greatest contribution, about a third of the third, comes from the B&O Tax. The state's portion of the Property Tax amounts to a fourth of that third. And the remaining revenue sources make up the last ... let's see ... five-twelfths of the third (about 11 percent of total revenues).

All of which means: As goes the Sales Tax, so goes the revenue stream. Sales Taxes averaged a 4.1 percent increase 1995-2004, but the last five-plus percent was in 2000.

Why are even my assumptions too optimistic? First, because I accept OFM's for the first two years. Second, in the absence of regime change, federal grants will increase less than federal mandates. Third, I allow the Sales Tax rate increases of the past ten years into my average as if they were simple increases in economic activity. In fact, the Sales Tax is under downward pressure from Internet sales and will also suffer along with the Property Tax when housing cools off. (It will suffer not only because the purchase of home furnishings will slow, but also from the loss of the construction labor input, which is taxed under the Sales Tax.)

The good news? The next biennium is in balance, thanks to the set-asides from this year's surplus.